We turn valuable university research and development into thriving software startups.

In doing so, we’re redefining the journey from innovative university research to successful market entry. Our approach is distinct from traditional venture capital (VC) firms, accelerators, and incubators. We’re a venture capital studio, accelerator, and incubator all in one.

Our novel approach is deeply rooted in our team’s firsthand experience working inside university tech transfer offices. This insider knowledge allows us to navigate the complex landscape of university bureaucracies efficiently, making us uniquely positioned to streamline the commercialization process of university technology like no one else.

Understanding the inefficiencies and bureaucratic hurdles of universities firsthand, we’ve developed proprietary processes and systems to identify, evaluate, and commercialize promising university technologies swiftly. By leveraging standardized license agreements and fostering strong university partnerships, we can bypass common obstacles, speeding up the journey from lab to market.

Through our unique process, we aim to optimize ROI for our investors and society by leveraging university-developed software technologies.

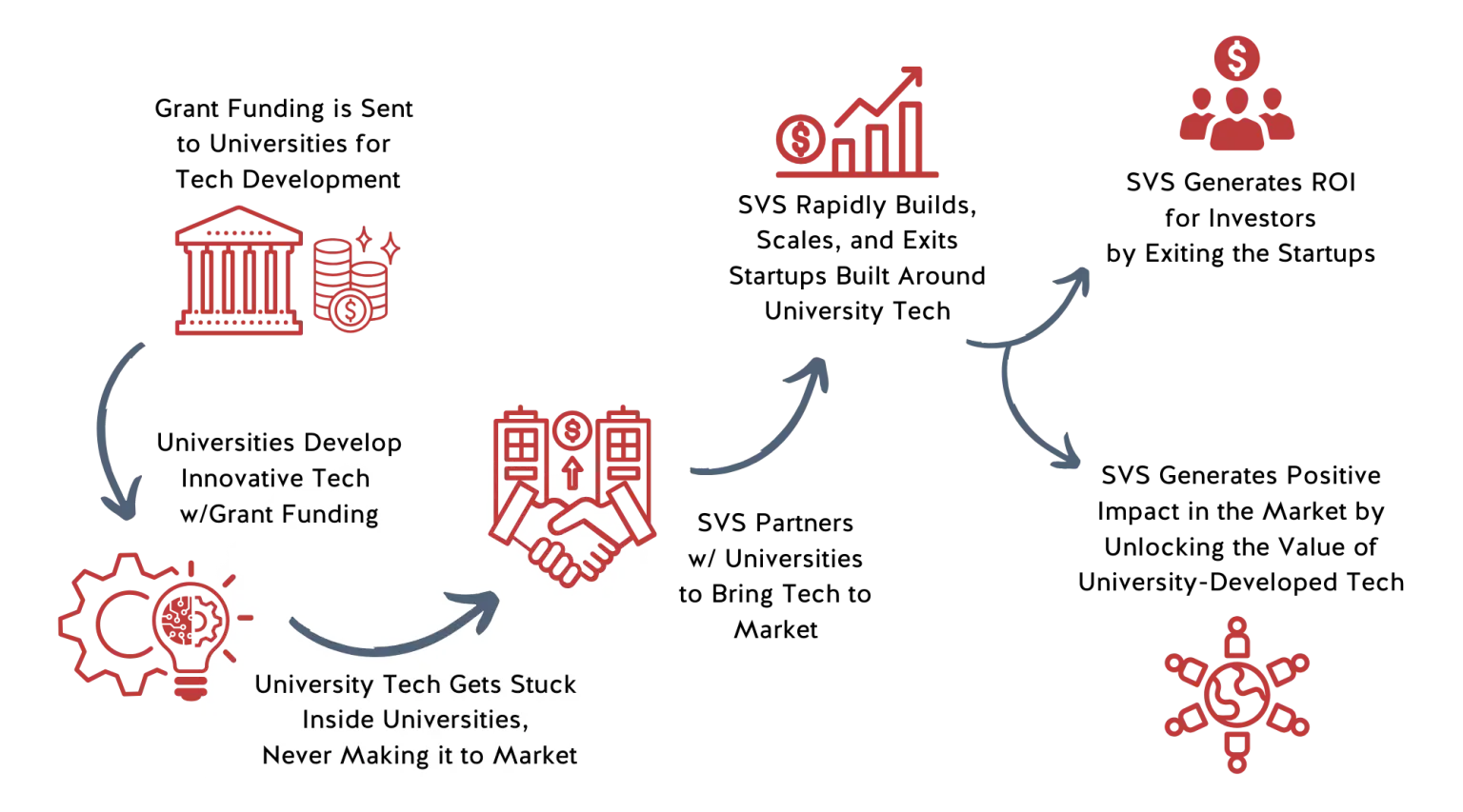

Every year, Universities receive billions of dollars in grant funding for technology research and development.

However, due to the bureaucratic procedures and red tape surrounding the university system, the funding and technology remain trapped within the university ecosystem (less than 10% of university innovations are ever commercialized).

But SVS is here to solve the problem.

We have partnered with universities nationwide to bring their latest technological innovations to the public. SVS’s unique investment and startup acceleration model unlocks the value of these under-leveraged software technologies.

In doing so, SVS creates immense value for society through technological advancement, empowers universities to fulfill their purpose in advancing societal development, and provides a one-of-a-kind deal flow to investors.

At SVS, we’ve reimagined the pathway from innovative academic research to successful market entry.

Our unique process – Discover, Develop, Deploy – is designed to identify, nurture, and exit high-potential software companies rooted in university intellectual property (IP). Here’s how we differentiate ourselves with our novel approach to deal flow and the proprietary strategies we employ at each stage.

SVS and its investors are committed to exclusively working with university-originated tech so that we can concentrate on maximizing their unrealized potential.

Our team of analysts, armed with proprietary AI-powered tools, proactively seek out and screen high-potential technology for licensure and investment. Our investment committee reviews potential deals after thorough research and validation.

Summit Venture Studio doesn’t just invest through funding – we also provide our startups with in-house marketing, financial, and sales support. Our fractional services help portfolio company presidents leverage added expertise and accelerate their path to success with a solid foundation that scales with growth.

We hire entrepreneurially minded presidents who lead out in sales initiatives, go-to-market strategy, and developing key partnerships for eventual acquisition or fundraising. Additionally, Summit Venture Studio develops, deploys, commercializes, and exits solutions with the help of industry partners and experts.

SVS has closed its first round of funding and launched over a dozen university software startups built around university technology. Many of these startups have gained initial customer traction and revenue growth and are on the path to acquisition or further investments.

Our portfolio spans numerous industries, including higher education, elite sports performance, health tech, and more.

During our first year, we analyzed several hundred investment opportunities through our partnerships with more than 60 universities and launched over a dozen startups.

As we continue to expand our university network and refine our commercialization processes, we’re always looking for new technologies, partners, and team members. We are building tools and processes to streamline taking ideas to companies to revenue.

At SVS, we’re not just envisioning a future where university innovations reach their full market potential — we’re creating it. Join us in transforming the landscape of tech commercialization.

SVS fosters a rich ecosystem of inventors, industry experts, and strategic partners, providing a comprehensive support system for its ventures. This collaborative model accelerates development, enhances market fit, and facilitates successful exits.

Investing with SVS offers a unique opportunity for investors. Our university partnerships give us the chance to invest in technologies that were previously unavailable.

We also take significantly larger equity stakes in the software startups we create than the average early stage investment fund does. This advantage, combined with our ability to provide support for go-to-market and growth through our in-house services and partnerships, enables us to accelerate and enhance liquidity events, providing significant benefits to our investors.

The SVS portfolio company president role is truly a unique opportunity for entrepreneurs.

Are you someone who is entrepreneurial-minded but needs an idea and resources? We provide motivated entrepreneurs the unique opportunity to step into a “startup in a box” opportunity where you’re provided with developed innovative technology, funding, and expert resources at your fingertips.

Harnessing SVS’s proprietary investment and startup acceleration model, we take these nascent software technologies and unlock their previously trapped value.

Interested in partnering, or working with us?

Reach out – we’d love to hear from you.